by Clara Pelaez Florez | May 10, 2022 | Business, English, U.S. Hispanic

Financial habits and needs of the US Hispanic population One of the most significant social problems facing Latinos in the United States is the myriad of obstacles that prevent them from building a secure financial future. These financial differences begin with...

by Edward Norton | Nov 23, 2021 | Latin America, U.S. Hispanic

Latin America’s Electoral Agenda for 2022 2022 is a big political year for Latin America. After presidential elections in Chile later this year, we will see further elections in Colombia and Brazil. Electoral panorama in Latin America Costa Rica (02/06/2022)...

by Edward Norton | Nov 15, 2021 | Culture, English, U.S. Hispanic

Do Latinos Celebrate Thanksgiving in the US? Thanksgiving Day, is an annual national holiday in the United States and Canada that celebrates the harvest and other blessings of the past year. In 1621, the Plymouth colonists and the Wampanoag shared an autumn harvest...

by Alejandra Jiménez | Sep 1, 2021 | Culture, English, Latin America, U.S. Hispanic

September 5th is International Day of Indigenous Women. This date was chosen in 1983, during the Second Meeting of Organizations and Movements of America, held in Tihuanacu, Bolivia. The objective of this celebration is to recognize all the indigenous women who...

by Edward Norton | Aug 30, 2021 | Business, U.S. Hispanic

Reaching US Hispanics with Programmatic Advertising Hispanics have played a significant role in driving U.S. population growth over the past decade. The U.S. population increased by 18.9 million, and Hispanics accounted for more than half (52%) of this growth,...

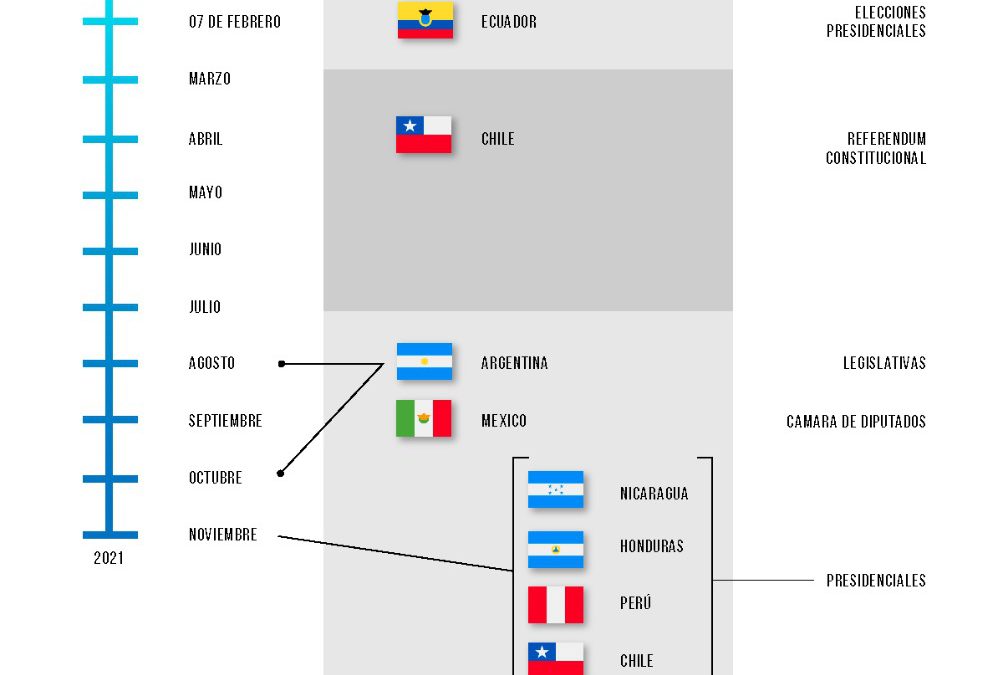

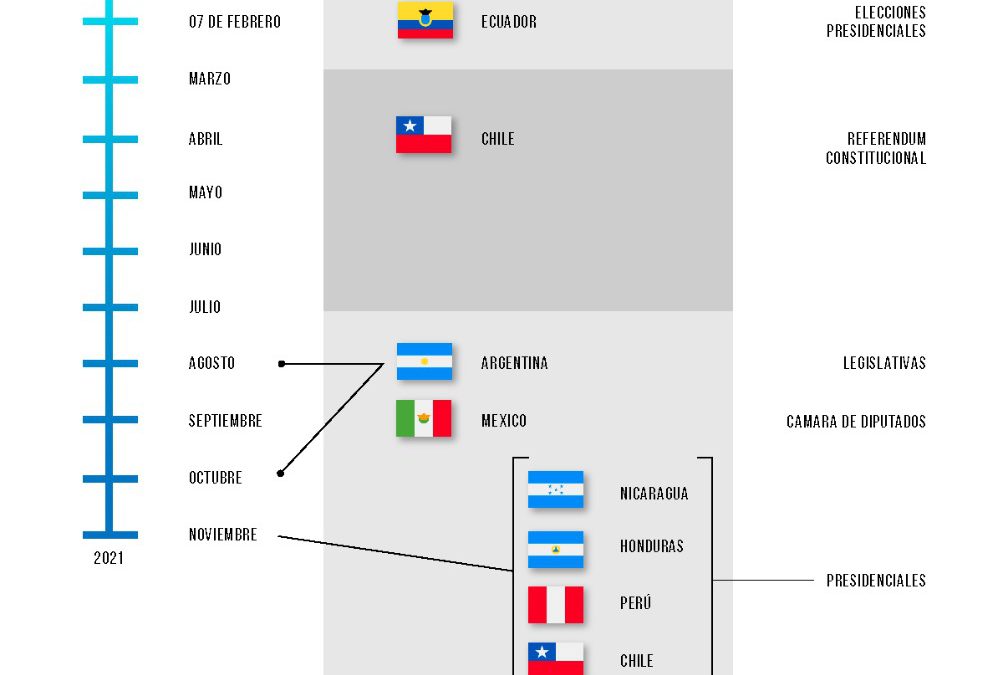

by Alejandra Jiménez | Apr 9, 2021 | Latin America, U.S. Hispanic

Latin America’s Electoral Agenda for 2020-2021 Elections in Latin America and the Caribbean face protracted polarization. Sars-cov-2 pandemic has caused an extension on alternative plans to fulfill the agenda which has been delayed in most cases. All these...